But what makes bobby bonilla day so iconic isn’t just the number—it’s the story of a deal that blended bad decisions, financial wizardry, and long-term consequences.

Who Is Bobby Bonilla?

Bobby Bonilla was once a six-time All-Star and a World Series champion with the Florida Marlins. During his career, he played for several MLB teams, including the New York Mets, Pittsburgh Pirates, and Atlanta Braves. Bonilla was known for his powerful bat and was once one of the highest-paid players in the league.

His career spanned from the mid-1980s to early 2000s, but it’s his post-retirement income that keeps his name alive today.

The Infamous Mets Deal

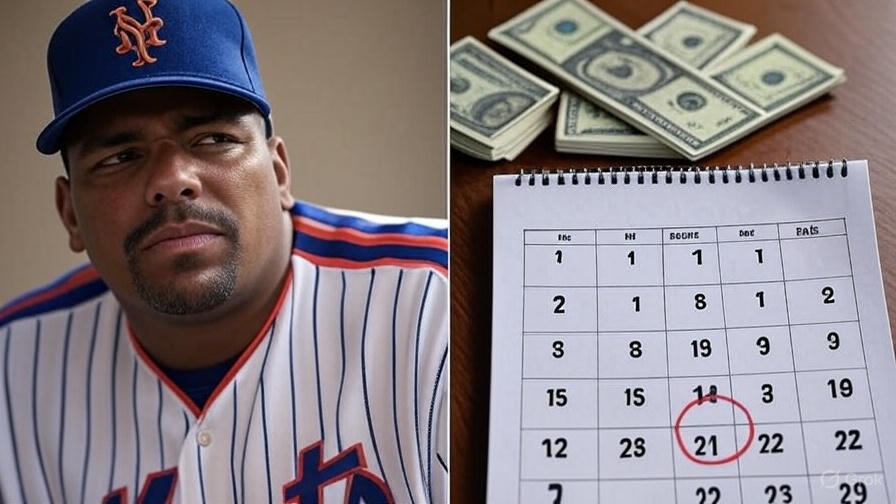

In 2000, the Mets agreed to buy out the remaining $5.9 million on Bonilla’s contract. Instead of paying it outright, they struck a deal to defer the payment with interest. The result? Bonilla would receive $1.19 million annually from 2011 to 2035.

The Mets believed they would earn more through investments with Bernie Madoff than they would lose by deferring Bonilla’s money. But when Madoff’s Ponzi scheme unraveled, so did the Mets’ financial plan.

Why July 1 Is Now Celebrated

July 1 is unofficially dubbed “Bobby Bonilla Day” on social media and sports news outlets. It’s a yearly reminder of one of the most famous contracts in sports history and a running joke among MLB fans and analysts alike.

Over time, bobby bonilla day has become a symbol of how not to manage a sports franchise—or perhaps how smart financial planning can make an athlete’s retirement secure.

From memes to media coverage, July 1 now brings a wave of nostalgia, sarcasm, and money talk across the internet.

Bonilla’s Deal vs Other Deferred Contracts

What sets Bonilla apart is the perfect storm of the deal’s timing, amount, and the Mets’ failed investment strategy.

Public Reaction and Cultural Impact

Every year, bobby bonilla day trends on Twitter, dominates Reddit threads, and even gets TV coverage. Fans joke that Bonilla is the “smartest man in baseball” and use it as a lesson in long-term financial planning.

It’s rare for a contract clause to enter popular culture, but Bonilla’s deal has become a financial folklore, often referenced in finance books, podcasts, and sports business lectures.

While the Mets may cringe at the memory, Bonilla is now a symbol of player empowerment — and how sometimes, waiting pays off big.

What Bonilla Has Said About It

Despite all the headlines, Bobby Bonilla himself has remained relatively humble and humorous about the deal. In interviews, he’s often grateful and amused at the attention, noting that he simply trusted his advisors at the time.

He’s also hinted at working on a documentary or book about bobby bonilla day and the business side of pro sports. Fans would no doubt be eager to hear the full story from the man himself.

What Can Athletes and Teams Learn?

Bonilla’s deal taught MLB teams the risks of deferred payments and the importance of financial oversight. At the same time, it showed how athletes can secure generational wealth through patience and smart contracts.

As more players consider long-term strategies for retirement, bobby bonilla day serves as both a case study and a cautionary tale.

Could This Happen Again?

Actually, it already has. Multiple teams now offer deferred deals to reduce short-term payroll pressure. But thanks to modern contract structuring, most are more balanced than Bonilla’s.

Still, none have captured the public’s imagination quite like bobby bonilla day. Until 2035, fans will continue celebrating a day when an ex-player gets paid big for doing absolutely nothing on the field.

Final Thoughts

The Bobby Bonilla contract is more than a quirky MLB footnote — it’s a masterclass in delayed gratification, a financial phenomenon, and a pop-culture icon. On every bobby bonilla day, fans are reminded that in sports — and in life — the smartest play might just be the long game.

Whether you admire the financial foresight or mock the Mets’ miscalculation, one thing’s for sure: July 1st is Bobby Bonilla’s favorite day of the year.